Other languages

- ...

- » Starting and running a Swedish business

- » Declaring Taxes – Businesses

- » Rot and Rut work

- » The client may not be a closely related person

The client may not be a closely related person

A precondition for receiving a payout for ROT and RUT work is that you do not carry out work on behalf of yourself or of someone with whom you have a close (family) relationship.

This applies even where your company, e.g. joint-stock company, sells the service and the work is carried out by the client or by a closely related person. Neither can an employee of your company carry out work for a person who has a close family relationship with him or her.

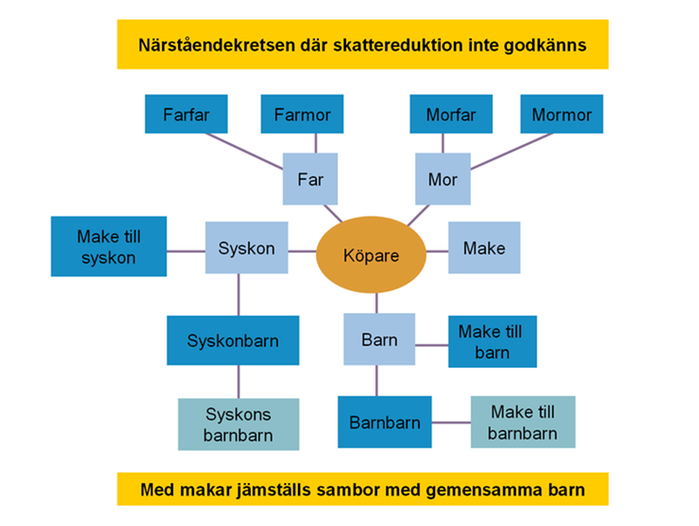

Who counts as a closely related person for tax purposes?

Who counts as a closely related person shall be determined from the viewpoint of the client.

The following are included in this designation:

- spouse,

- parents,

- grandparents,

- offspring (child, grandchild and great grandchildren), spouse of offspring, and

- brothers and sisters, their spouses and offspring.

Also considered to be spouses are co-habitees who have previously been married with one another or have, or have had, children in common.

Example of client not considered to be a closely related person

Per and Olle are siblings. Olle has a sole proprietorship which carries out building refurbishments. He is registered for corporate taxation (F-skatt) and also has employees.

Per hires Olle’s firm to undertake ROT work on the housing unit of which he is the proprietor. Olle sends one of his employees to carry out the work on his brother’s property and then invoices Per for this work.

Can Per obtain a tax reduction despite the fact he has hired his brother’s firm to do the work?

Yes, in this case Per is able to obtain tax relief for ROT work since it is not his brother, Olle, who himself undertook the work. If, on the other hand, Olle had carried out the work at Per’s house then Per would not have been able to obtain tax relief, since a tax reduction is not permitted when the work in question has been carried out by a closely related person.

ROT and RUT work on own home when you are a tradesman within the building industry

If you have a sole proprietorship which carries out ROT and RUT work and plan to carry out work in your own home, then you must bear in mind the following:

- You are not able to engage your own firm (sole proprietorship) to do the work in your own home and receive tax relief.

- This applies even if you have an employee who would carry out the work since the condition for obtaining a tax reduction is that the person hiring the service has paid the service provider for carrying out the work undertaken. As a business owner you cannot invoice yourself.

- Nor can you hire someone else who is closely related to you to carry out the relevant work.

Example of when you cannot obtain RUT deduction with self-proprietorship

Olle has a sole proprietorship which carries out building refurbishment work. Olle is approved for corporate taxation (F-skatt) and also has employees. Olle plans to refurbish the kitchen in his own home and he hires his firm to carry out the work. Both Olle himself and his employees travel to Olle’s home and refurbish the kitchen in Olle’s property.

Can Olle obtain a tax reduction for the work carried out?

No, in this case Olle cannot obtain any tax reduction since Olle is not able to invoice himself. This applies even if his employees carried out the work.

On the other hand, where you have a company (joint-stock company, trading company, limited partnership or economic association) which is approved for corporate taxation (F-skatt), that carries out ROT and RUT work and that plans to undertake work in your own home, you can get a ROT and RUT deduction, on condition that you yourself do not carry out the work.

What this means is that you can hire your own company to carry out ROT and RUT work in your own home and get a tax reduction when an employee, who is not a closely related person, undertakes the actual work. Should you yourself participate in this work, then you cannot get a tax reduction for that part of the work and must deduct the man-hours that you worked.